Introduction

New NRSP Microfinance Bank Loan Officer Jobs 2024. NRSP Microfinance Bank has announced an exciting opportunity for aspiring individuals to join their team as Loan Officers in 2024. This is a fantastic chance for fresh graduates and experienced professionals to kickstart or advance their careers in microfinance. This article covers all the details about NRSP Microfinance Bank Loan Officer jobs for 2024, including job requirements, responsibilities, benefits, and the application process. New NRSP Microfinance Bank Loan Officer Jobs 2024.

About NRSP Microfinance Bank

New NRSP Microfinance Bank Loan Officer Jobs 2024. NRSP Microfinance Bank Limited is one of the leading microfinance institutions in Pakistan, dedicated to empowering low-income households and small businesses by providing them with financial solutions. The bank is known for its extensive rural outreach, offering a wide range of microfinance services to help underserved communities improve their living standards. NRSP Bank’s mission is to support economic growth at the grassroots level through affordable credit options and financial inclusion initiatives.

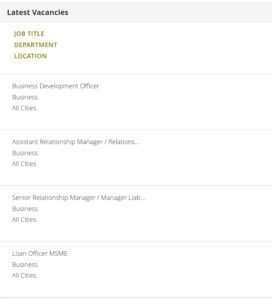

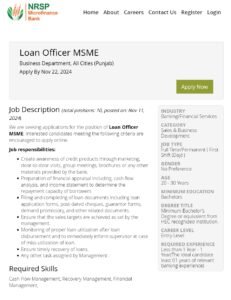

Job Overview: Loan Officer

New NRSP Microfinance Bank Loan Officer Jobs 2024. The Loan Officer position at NRSP Microfinance Bank is designed to support the bank’s microcredit services. As a Loan Officer, you will play a key role in evaluating loan applications, managing client relationships, and ensuring that clients receive the necessary support to grow their businesses.

Key Responsibilities:

– Conduct field visits to assess the financial needs of potential clients.

– Evaluate loan applications and verify clients’ creditworthiness.

– Maintain a portfolio of active clients and ensure timely loan repayments.

– Provide financial advice and support to clients for their business growth.

– Prepare and submit loan proposals to the credit committee for approval.

– Ensure compliance with NRSP Bank’s policies and procedures.

Eligibility Criteria:

To be considered for the Loan Officer position, candidates must meet the following requirements:

– Educational Qualification New NRSP Microfinance Bank Loan Officer Jobs 2024: Minimum Bachelor’s degree (preferably in Business Administration, Commerce, Economics, or a related field).

– Experience New NRSP Microfinance Bank Loan Officer Jobs 2024: Fresh graduates are encouraged to apply, although prior experience in microfinance or banking will be an added advantage.

– Age Limit New NRSP Microfinance Bank Loan Officer Jobs 2024: 21 to 35 years.

– Skills: Strong communication, negotiation, and analytical.

– Other Requirements: Willingness to travel extensively for fieldwork and client meetings.

Benefits of Working with NRSP Microfinance Bank

Working with NRSP Microfinance Bank offers numerous benefits, including:

– Competitive salary packages and performance-based incentives.

– Comprehensive training programs for career development.

How to Apply for NRSP Microfinance Bank Loan Officer Jobs 2024

If you are interested applying Loan Officer position NRSP Microfinance Bank, follow these steps:

1. Prepare Your CV: Update your resume to highlight your educational qualifications, skills, and any relevant experience.

2. Submit Your Application Online: NRSP Microfinance Bank uses online recruitment platforms like Rozee.pk for job applications. To apply:

– Visit rozee.pk] and create an account (if you don’t have one).

– NRSP Microfinance Bank Loan Officer Jobs 2024.

– Fill online application form.

3. Email Your CV (If applicable): Alternatively, you can send your CV to NRSP Bank’s official recruitment email, which is often provided in the job advertisement.

4. Application Deadline: Ensure that you submit your application before the closing date specified in the job advertisement to avoid missing out on this opportunity. New NRSP Microfinance Bank Loan Officer Jobs 2024.

Conclusion

NRSP Microfinance Bank Loan Officer jobs for 2024 present a unique opportunity for ambitious individuals to build a fulfilling career in the banking sector. If you are passionate about financial inclusion and eager to make a difference in underserved communities, this role could be the perfect fit for you. Don’t miss out on this chance to join a leading microfinance bank in Pakistan and take your career to the next level. New NRSP Microfinance Bank Loan Officer Jobs 2024.

Here are five important questions and answers regarding NRSP Microfinance Bank Loan Officer jobs for 2024:

1. What are educational requirements for Loan Officer position.

Answer:

To be eligible for the Loan Officer position at NRSP Microfinance Bank, candidates must have a minimum of a Bachelor’s degree. Preferred fields of study include Business Administration, Commerce, Economics, Finance, or other related disciplines. Fresh graduates are encouraged to apply, but having prior experience in microfinance or banking can be advantageous.

2. What are the primary responsibilities of a Loan Officer at NRSP Microfinance Bank?

Answer:

As a Loan Officer at NRSP Microfinance Bank, your main responsibilities will include:

– Conducting field visits to assess clients’ financial needs and eligibility for loans.

– Evaluating loan applications and verifying clients’ creditworthiness.

– Managing a portfolio of clients, ensuring timely loan repayments.

– Providing financial guidance to clients for their business growth.

– Preparing loan proposals for the credit committee’s approval.

3. How can I apply for the NRSP Microfinance Bank Loan Officer job in 2024?

Answer:

You can apply for the NRSP Microfinance Bank Loan Officer position by following these steps:

1. Visit Rozee.pk: Create an account or log in if you already have one.

2. Search for NRSP career Listings: Use keywords like Microfinance Bank Loan Officer Jobs 2024.

3. Submit Your Application: Complete the online application form and upload your updated CV.

Alternatively, you can also send your CV directly to the bank’s official recruitment email if specified in the job advertisement. New NRSP Microfinance Bank Loan Officer Jobs 2024.

4. What skills are required to be successful as a Loan Officer at NRSP Microfinance Bank?

Answer:

To excel as a Loan Officer, the following skills are essential:

– Strong Communication: Ability to clearly communicate with clients and colleagues.

– Analytical Thinking: Capable of evaluating loan applications and assessing financial risks.

– Customer Service Orientation: Prioritizing client satisfaction and building long-term relationships.

– Negotiation Skills: Convincing clients to adhere to loan repayment schedules.

– Willingness to Travel: Comfortable with extensive travel for field visits to meet clients.

- New NRSP Microfinance Bank Loan Officer Jobs 2024

- new nrsp jobs 2024

- New NRSP Microfinance Bank Jobs 2024

- new nrsp vacancy in pakistan

- new latest bank jobs

- new latest careers oppertunity

- how to apply nrsp microfinance bank jobs

- how to apply nrsp jobs in pakistan

- new loan officers jobs 2024

- how to apply loan officer jobs

- new jobs 2024

- new jobs in pakistan

- new career oppertunity 2024

- new career oppertunity in pakistan

- new vacancy 2024

- new vacancy in pakistan

- alertjobsnext

- alertjobsnext.com

- job

- career

- vacancy

- bank vacancy in pakistan 2024

- new bank jobs 2024